Figuring out how to start a business in Canada is a daunting process. You’ve got to get a business license, figure out taxes, and so much more. The mountain of paperwork between a great business idea and becoming your own boss might seem insurmountable.

But don’t worry. By following this ADHD-friendly guide, you can move through the process with confidence.

This guide is based on my own experiences of how to start a small business in BC, and does not constitute legal counsel. I hope you will find it helpful. I’ve tried to make this info as accessible as possible by using:

- bulleted lists,

- small chunks of text,

- breakout quotes,

- images, and

- plenty of white space.

I’ve included loads of helpful details, including how much it costs to register a business in BC, licenses you need to run a business (even if you’re self-employed), and links to government and other resources. If you have any questions, suggestions for tips to add, or just found this helpful, please drop a comment below! I would love to hear from you!

how to use this guide:

I recommend reading the whole thing before taking any concrete steps, so that you will have some idea of the path ahead. I should also note that a few of the resources I mention are specific to BC, such as WEBC. But if you’re tuning in from another province or territory, don’t worry – most of the organizations and companies I mention have a national presence.

If you don’t have the energy for a thorough reading, skimming through just headlines and highlights will still give you a decent idea of the whole process. ♥

step 1 of 10: decide to start a business.

Before you jump into the business-making process, it’s wise to consider whether you and your entrepreneurial dream are likely to falter or thrive.

Three key questions to consider are:

- Do I have the time and energy?

- Do I have the skills I need?

- Do I have a viable business idea?

Let’s go over these three questions.

Q: do I have the time & energy?

Starting and running a business takes a lot of time and energy. If you have limited time, or energy, or both, that doesn’t make it impossible for you to have a successful business. But it is a factor to be aware of, so that you set realistic expectations.

You’ll need to have strategies in place for low-energy days and no-time days.

This could look like:

- pacing yourself (“I’m going to spend 6 hours per week on this”),

- delegating (“figuring out advertising is draining, so I’m going to hire someone for that”),

- having alternate sources of income, and/or

- keeping your overhead low so that business expenses don’t pile up.

Q: do I have the skills I need?

Some of the key skills involved in starting and running a business include research, planning, decision-making, dealing with paperwork, conflict resolution, organization, math, and salesmanship.

You don’t necessarily need ALL of these to be successful, but it’s wise to know if you are lacking in any of these areas, and be ready to strategize to cover any skill gaps.

“Successful entrepreneurs possess a host of skills that are required at all stages of their journey.

They must have the capacity to:

- identify opportunities when they emerge

- communicate their vision to sometimes sceptical audiences

- leverage resources from multiple sources

- effectively collaborate with different expertise

- navigate complex rules and regulations, and

- drive processes towards results.

The good news is, these skills are learnable. So, if you identify an area that is a weakness for you, you can take some time to hone that skill through practice and training.

Q: do I have a viable business idea?

It’s a good idea to consider whether your business idea will end up being profitable. You can do some preliminary research on this by looking at trends in your chosen industry. For example, if you plan to sell a new kind of soap, and the forecast is for the personal hygiene product market to be over-saturated, you might have difficulty finding customers.

Ideally, you should have some idea of the market opportunity that your product will fill — that is, an unmet need that your target customers have.

We will dig deeper into this in the next step.

step 2 of 10: the business plan.

A business plan is a document that neatly lays out all the aspects of your business.

That’s right.

All.

Of.

Them.

I’m not going to lie to you, it’s a painful process (even for me, a neurotypical™). It takes a lot of time, and some parts of it are boring or anxiety-inducing.

But it’s sooooo worth it, and there are lots of great tools to help you succeed. Do not – DO NOT – skip this step. Even if your business is already up and running, I would still recommend that you create a business plan.

So let’s look at what it contains, and how it will help future you.

business plan sections.

The sections of your business plan include the following (this is not a comprehensive list; I will give you an actual template link further in the article under free resources):

- Company description.

- Product description, including key benefits and features.

- Market analysis, including target market and industry analysis.

- Marketing plan, including pricing, distribution, and advertising.

- Operations plan, including inventory, supply lines, and personnel.

- Financial plan, including costs, projected sales, and funding needed (enlist an accountant to help with this if math is not your friend).

- Risk analysis and contingency planning.

Yes, it’s a lot. But stay with me.

the benefits of a business plan.

The benefits of creating a business plan far outweigh the cost. 30% of Canadian businesses fail within the first five years. Doing your due diligence by having a business plan puts you on the path to success – and you will have peace of mind knowing exactly what that success should look like at every step along the way.

A business plan helps you to:

- Clarify your company mission and values

- Discover the size and shape of your market niche

- Learn more about the industry you are entering and its important trends

- Pinpoint your ideal customer and learn how to sell to them

- Identify concrete milestones of success and a timeline for them (for example, hiring your first employee after six months)

- Have backup plans for when things go wrong, such as supply line interruptions or a vital office computer failing

I’ll say it one more time: creating your business plan is the single most important thing you can do to set your business up for success. Do. Not. Skip. It.

but HOW do I create a business plan?

Great question!

The first piece of advice I have for you is, don’t do it all at once. A business plan has many sections. Some are easy to fill out, while others require a lot of thought and research. Try to do a manageable chunk each day, and take some days off to rest and recharge. And if a section is giving you too much trouble, leave it for now.

Secondly, there are lots of tools, guides, templates and other resources available online to get you through this. Many of them are even free!

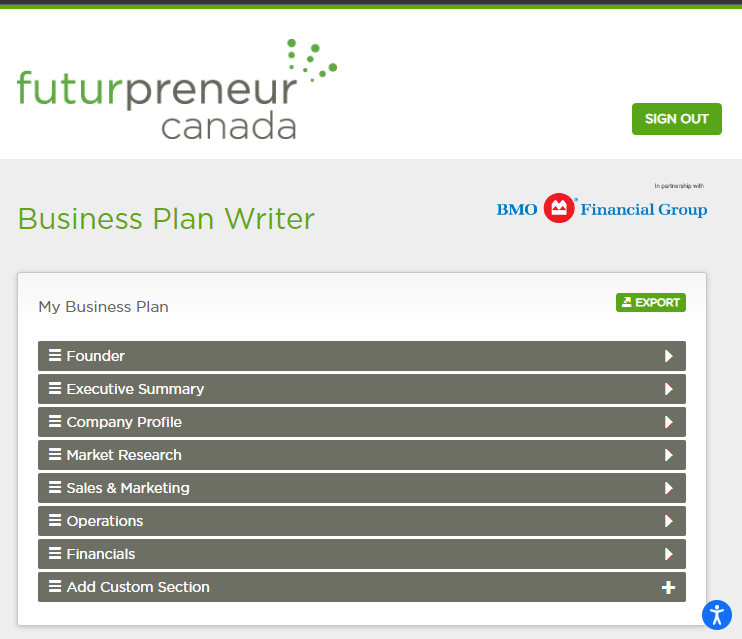

free: Futurpreneur Business Plan Writer

My favourite business plan resource is Futurpreneur. Futurpreneur is a Canadian org dedicated to helping young entrepreneurs (ages 18-39) succeed. That covers a lot of us, but if you don’t fall into that category you can still use their free tools — you just won’t be eligible to apply for their loans. And if you identify as part of a marginalized group, Futurpreneur specifically welcomes you, and may have additional supports available!

You can browse through their extensive list of supports, but for the moment, the tool to get to know is their Business Plan Writer. This is your business plan template, with built in tips for each section.

You can fill it out online, and then download it when you’re done.

free: UBC Business Accelerator

Another great free resource is UBC’s Small Business Accelerator Program. They have guides for over 100 different kinds of businesses, to get you through researching and writing your business plan.

Basically, if Futurpreneur’s Business Plan Writer is the body of your business plan, UBC’s guide is its brain.

free: WEBC support meeting

A third resource worth mentioning, although it’s only for women (sorry he’s and they’s), is WEBC. They have regular free online meetings where an expert will go over the basics of the business plan and then take any questions you might have.

free: the library

Last on the list of free resources is your local public or university library. A lot of libraries have staff trained SPECIFICALLY to help with business plan market research! (We really don’t deserve libraries.) You can find more specifics on how to make use of library resources in UBC’s guides.

paid business plan resources:

Paid resources for creating and fine-tuning your business plan include your friendly neighbourhood accountant and lawyer. Hourly rates for these professionals usually start well over $100 an hour, but it can be worth every penny for the quality of their business advice. And as a bonus, you will have started a working relationship that you can build on for future business advisory needs, such as legal contracts and tax returns.

Futurpreneur and WEBC also offer business plan review services; WEBC charges $220 (women only), and Futurpreneur offers it as part of their loan application process (ages 18-39 only).

Small Business BC offers a business plan review service as well, for $150, either independently or as part of a loan application.

so, to sum up:

-

free business plan resources:

- Futurpreneur’s business plan writer

- UBC’s small business accelerator

- WEBC meetings (women only)

- the library

-

paid business plan resources:

- a local accountant ($150+)

- a local lawyer ($250+)

- Futurpreneur business plan assistance (ages 18-39, must apply for a loan)

- WEBC business plan review ($220, women only)

- Small Business BC Business Plan Consulting ($150)

If you have any questions about your business plan, or just need a shoulder to cry on about it, feel free to reach out to me in the comments, or shoot me a message via my contact page.

step 3 of 10: bring in a professional.

step 3 of 10: bring in a professional.

The DIY approach can get you through many parts of the business startup process, but it’s almost inevitable that at some point you will need expert guidance on the “boring” parts. Let’s take a look at whether you would benefit from the help of a lawyer or an accountant.

Q: do you need a lawyer?

Not everyone who starts a small business needs to get a lawyer involved, but it’s wise to at least consider it. Lawyers who specialize in helping Canadian small businesses can give you the best advice on everything from business structure, to trademarking, to the wording of contracts and invoices. If you think you could use some paid support to make sure your business is exactly where it needs to be from a legal perspective, have a chat with a local lawyer to see what they can do for you.

There will most likely be a charge for a consultation, but you can minimize the cost by keeping the conversation brief (try to book a 30 minute meeting) and going with a small local firm rather than one of the big heavy-hitters.

Don’t forget to ask before you go what exactly the fee will be, and don’t be afraid to shop around for a lawyer that will be the best fit for you and your business.

If you do get a lawyer, and they create some documents for you such as a client contract, don’t forget to go back and add those in to your business plan!

Q: do you need an accountant?

Just like with the lawyer question, the answer here is, if you have the budget for one and it makes you feel more comfortable letting a professional deal with your finances, go for it! No one will be able to give you better money advice than a small business accountant.

Business needs that an accountant can help with include getting your financial software set up, sorting out payroll for employees, dealing with your taxes, and brushing up the financial section of your business plan, including projected cash flow.

step 4 of 10: market research.

If you’ve completed your business plan, you’ve already done some market research. But it’s worth taking some more time to really lean into this side of things through primary research, such as a survey or focus group, to make sure that you put your product or service’s best foot forward.

If you don’t do your research on who you are selling to, all your marketing strategies will be guesswork.

If you have a budget for starting your business, this is a good place to allocate some funds. If you’re starting on a shoestring, hunt down some free resources to help flesh out your target customer and how to sell to them, and go have conversations with people who you think would be good customers for you, to see if they would actually buy what you’re planning to sell.

Your business plan can serve as an operating manual for this. You can document your market research plan in the business plan, work out the steps you need to take, and then include the results of the research in the business plan as well.

Your business plan is a living portrait of your business. Keeping it continually updated will help you to quickly identify any areas where you need a course correction.

step 5 of 10: register your company.

You can skip registering (as a sole proprietorship) only if your company name is your own name, with no other words before or after it, and you are not planning on opening a business bank account or seeking business loans. (This is the case for some realtors, for example.)

If that’s not the case for you, follow these steps to register your company:

first, reserve your company name.

The first step to registering your company in B.C. is reserving your company name, which you can do through the B.C. business name registry, Name Requests Online. This tool allows you to check for any conflicts of interest with your name before you submit. You also need to provide two alternate names when you submit the request. The cost for this is $30, and it may take up to a week or two for your request to be processed.

If you successfully reserve your name, you then have 56 days to register your business (keep in mind that registering your business can take another week or two!). If you don’t register your business in this time frame, you will need to request the name again and pay the fee again.

next, register your business.

In order to register your business, you’ll need to decide on your business model, usually either a sole proprietorship or a corporation, although other models exist.

A sole proprietorship is the simplest and cheapest business model in Canada, and the one most often chosen by new businesses. It can also be converted to a corporation at a later date. (Or, if you like the simplicity of the sole proprietorship but your company has two or more owners, you may wish to consider a general partnership, which is functionally similar to a sole proprietorship.)

| Sole Proprietorship | Corporation |

|---|---|

|

|

Once you have chosen a business model, go to OneStop, the B.C. government portal for registering your business. Registering will provide you with a business number. The cost of registering is $40, and it takes a week or two for the registration to process.

If you have chosen to incorporate, you start that process (filing articles of incorporation, which a lawyer will probably need to help you with) after you have your business number. The cost to incorporate in B.C. is $350.

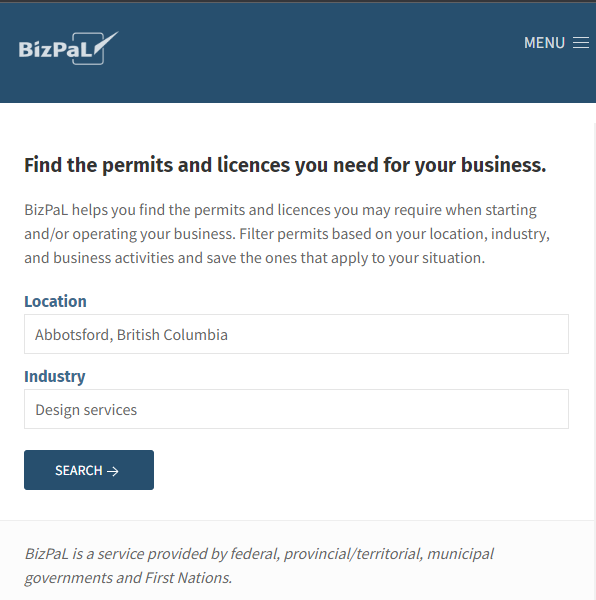

more registrations!

There will most likely be additional licenses and registrations you will need in order to run your business, such as a license to do business in your city, and PST/GST registrations if your business requires them. You can use the BizPal tool to figure out which licenses you need.

step 6 of 10: get business insurance.

Business insurance protects you in case you get sued or experience other financially damaging things that are out of your control. If you have created a sole proprietorship, you may also wish to get yourself a company healthcare plan, and get set up to to make CPP/EI contributions, while you’re at it.

step 7 of 10: secure funding.

When seeking funding, have your business plan at the ready to show off to potential investors, and be ready to “pitch” your business (this will sound a lot like the executive summary of your business plan). Make sure you can speak clearly about how much money you are looking for, what exactly it will be used on, and how long you expect it to take for you to pay it back.

While it’s a good idea not to borrow more than you need, it’s also important to secure enough funding that your business will be able to survive the ups and downs of the first few years.

The following sources of funding are available to supplement your personal contribution:

loans.

A business loan from a bank is one option for funding. Most banks offer this, so if you already have a bank you are comfortable with, you can start by reaching out to them. Canadian banks and credit unions that specialize in business loans and other business services include Vancity, Scotiabank, BDC (Business Development Bank of Canada), and RBC (Royal Bank of Canada).

Business loans can also come from organizations rather than banks, if you fit the criteria that the organization is looking for. Futurpreneur and WEBC are two examples of this.

investors.

Another potential source of startup capital is an angel investor. These are usually industry experts who will want to play an active role in mentoring or administering your business, to make sure that they will see a return on their investment.

Similarly, if you pursue the investment of a venture capitalist, they will have very specific ideas about owning part of your company, so that when it becomes the next big thing and goes public, they will reap big financial rewards.

crowd funding.

If you need start-up capital but don’t want to go into debt, sell shares of your company, or give up seats on your executive board, then you may wish to consider crowd-funding. This business model can be workable when you have some kind of concrete “perk” that you can offer to micro-investors in return for their buy-in.

grants.

Finally, there are some grants available for Canadian small businesses. Competition for these is steep, and not all businesses are eligible to apply, but it doesn’t hurt to look into!

-

so to summarize, sources of start-up capital can include:

- a loan from a bank

- a loan from an organization

- an angel investor

- a venture capitalist

- crowd-funding

- grants

If you’re not sure which of these models is right for you, an accountant could help out with some expert advice.

step 8 of 10: brand identity.

You may already have some notes on brand identity and product positioning in your business plan. But investing in a branding package from a design firm can make sure that you have a polished brand that will appeal to your target market niche.

what is a brand identity?

Your brand identity is the story that your company tells about itself — and that your clients tell to their friends and family. It includes visual components, verbal components, value components, and affective (feeling) components.

Specifically, your brand identity may include:

- company name

- logo

- packaging designs

- brochures

- business cards

- company tone of voice

- mission statement

In general, you can expect to allocate between 5% to 20% of your total starting budget on branding, though your percentage could be lower or higher, depending on how much you depend on your brand for business success.

Businesses that invest in branding consistently outperform those that do not, because a recognizable brand accelerates your company’s ability to build relationships with customers.

If you don’t feel like doing the math, I can work with you to determine to how much of your budget would be appropriate to spend on branding, based on your overall budget and business model. You can also check out this cheat sheet on recommended branding budgets for businesses with varying amounts of startup funds.

step 9 of 10: company website.

It is customary these days for almost every company to have its own website, and the total price for one varies wildly, depending on what you need. It is possible to go the “free” route and set up a website yourself that simply functions as an online business card. For some companies, such as those who are not concerned with finding customers or marketing themselves, that may be enough.

But for most companies, if you want a professional online presence, it’s best to invest in purchasing a domain that reflects either your company name or your services.

An added bonus of having your own domain is that you can have it as the extension of your email, instead of a personal extension such as @hotmail.com.

On the other end of the spectrum are fully custom websites with features such as client forms, internal company processes, and an online store. If that’s what will set your business up for success, expect to invest between $10,000 and $100,000.

step 10 of 10: your first customer.

There’s no better feeling than completing that first sale or service, whether the customer found you through an ad campaign or was a friend or family member. Especially if you know they had a great experience with you.

How you treat your first few clients will set the tone for your business in the days and years to come.

The best kind of advertising is word of mouth from your customers. It’s free, it’s natural, and it enhances your brand’s status as trustworthy and likeable. So make sure you give each customer the best possible experience, so that they will rave about you to family, friends, and even strangers! If possible, seek feedback from your customers on what they love, and areas you can improve.

From the very start, it is important to curate your customer base so that you are attracting your ideal clients: those who will benefit most from your product or service, and who are in a financial position to pay for it. For most businesses, it is NOT recommended to launch your business with steeply discounted rates. This may attract only people who do not appreciate the full value of your offering; and it may teach your customers to wait to make a purchase until the next discount comes around.

Instead of broadcasting discounts, if you get stuck waiting for your ideal customers, go find them, and build relationships with them in whatever way makes sense for you. And if that doesn’t work, invest in some more market research to see how you can improve your targeting.

and… done.

I hope you enjoyed this 10 step guide to making your business a reality. Feel free to send me an email or text with any feedback!